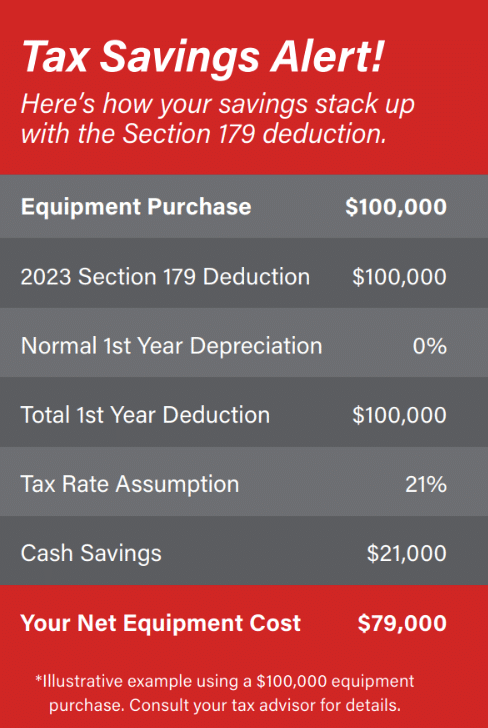

For businesses that heavily rely on material handling equipment and machinery, purchasing and maintaining these assets can add up to significant costs. However, if you are not already taking advantage of Section 179 of the Internal Revenue Code, you might be missing out on substantial savings. Section 179 of the US tax code is a provision that allows businesses to deduct the full cost of certain types of equipment, (including forklifts, sweepers, and scrubbers) in the year they are purchased, rather than depreciating them over several years. This can reduce the taxable income of the business and lower its tax liability for the year.

Qualifying for Section 179:

- For 2023, the deduction, set by the I.R.S., can be up to $1.16 million for qualifying purchases, both new and used equipment that is purchased or leased and put into service before year end, with a maximum cost of goods of $2.89 million. These limits are subject to change annually, so it’s crucial to consult tax professionals and stay updated with any legislative adjustments.

2. Qualifying property must be a tangible, depreciable property and businesses must have taxable profits.

3. The equipment you purchase for material handling must be used for business purposes more than 50% of the time and placed into service during the tax year you are claiming the deduction.

4. Procuring assets through lease or financing can also qualify, as long as the equipment is used for business purposes and meets other prescribed criteria.

Considerations and Best Practices:

This tax benefit is not automatic. Businesses must select this deduction by filling out IRS Form 4562. To write off eligible property in the first year it was purchased, you must include Form 4562 with your taxes and select the Section 179 deduction. You’ll need to list the property you’re claiming as the Section 179 deduction, with the price, and the amount you’re deducting.

In conjunction with Section 179 there is Bonus Depreciation. Often seen as a secondary consideration, it remains an important factor when tax planning. Bonus depreciation allows for an 80% deduction of the cost of new equipment over and above the Section 179 limits, providing more tax relief for a business with significant capital outputs.

Get Your Equipment Before the Deadline

The deadline for the Section 179 deduction is December 31, 2023. All qualifying equipment must be purchased or financed, delivered and in service by December 31, 2023. Businesses should always consult with a qualified tax professional before claiming Section 179 provisions to ensure they meet all the requirements and any limitations of the tax code.

Contact your Shoppa’s sales representative for availability today or call 866-506-2200 to request a quote.

You can also find a free Section 179 calculator available online to calculate how much you could save.